Leverage QuickBooks Online to help Your Business Bounce Back Sooner

- Susan Cook

- Jun 8, 2021

- 4 min read

Updated: Oct 6, 2023

The COVID-19 pandemic isn’t over, but many small businesses are on the upswing. In this month's newsletter, learn how QuickBooks Online can help if yours is still struggling.

A recent survey conducted by Intuit documented the financial losses that many small businesses have experienced since March 2020. Not surprisingly, the Intuit QuickBooks Small Business Recovery Report found that COVID-19 has had a significant impact on the financial health of U.S. small businesses. Despite the significant impact, however, many of the companies surveyed have proven resilient. As of March 31, 2021, 61 percent of surveyed businesses have actually seen an increase in annual revenue compared to pre-COVID days. How would you have answered the survey? If your business suffered financial and personnel losses because of the pandemic, has it started to rebound yet? If it hasn't, there are actions you can take in QuickBooks Online to help in your recovery. Here are some of them.

Transactions: Watch your income and expenses like a hawk.

How much time do you spend working with your downloaded transactions? If you take advantage of the quality tools QuickBooks Online provides, you may notice patterns to explore and adjust. For example, are you spending too much in one or more areas? When and where is your income dipping?

QuickBooks Online provides excellent transaction-tracking tools that help you document income and expenses. It’s critical that you connect as many of your online financial institutions as possible, so you get a complete picture of your income and expenses. Once these connections are established, click on Transactions in the toolbar, which should open to the Banking page. If you’re only going here to make sure there are no unrecognized entries, you’re missing out on some of QuickBooks Online’s transaction-tracking tools. In the image above, we’ve specified a vendor and chosen a Category and Tags. This can make your reports more meaningful and actionable. To learn more about Categories and Tags, read our article on the subject here. If you don’t know what it means to Find Match, we can show you how that works. It’s a significant time-saver.

Sales: Make it easier for customers to pay you.

We’ve written about accepting online payments in this column before. This approach is especially important if your business is struggling financially. You may actually be losing sales if you don’t allow potential customers to pay online through a credit card or bank account transfer. And existing customers may pay faster if they can do business with you in a way that's convenient for them. QuickBooks Payments makes this possible. There are some nominal fees involved, but the potential increase in your income should more than cover them. Let us know if you want us to help you set up a merchant account.

When you set up a merchant account through QuickBooks Payments, you may find that your customer base will grow, and existing customers will pay faster.

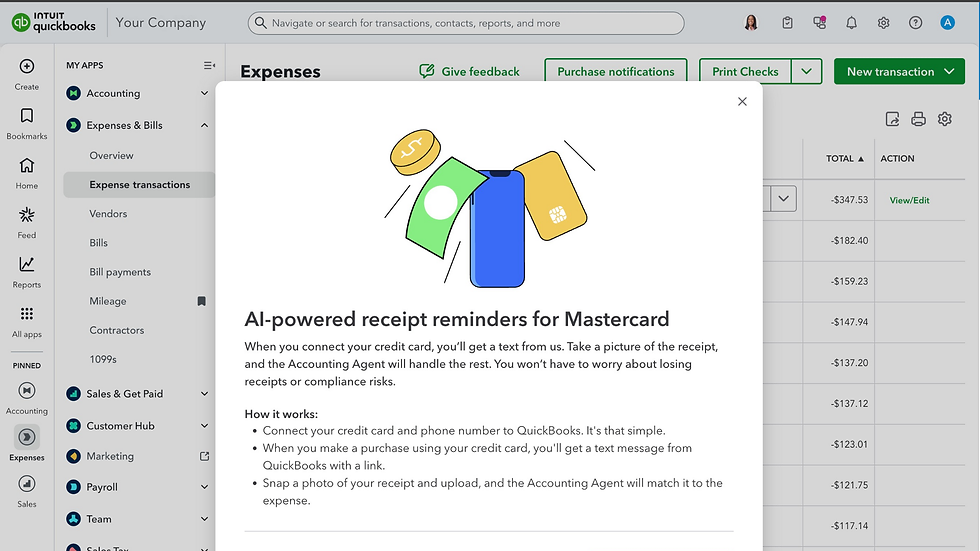

Expenses: Categorize expenses with tax time in mind.

You’ve probably already filed your 2020 income taxes, but we’re well into 2021, and it’s not too early to start thinking about your current tax situation. QuickBooks Online helps you track your income carefully, but it’s equally important to make sure you know what your tax-related expenses are. You want to get every deduction and credit you can. So when you’re looking at transactions, like we described above, make very certain that you’re assigning the correct categories to each of them. We can help you run reports on a quarterly basis that should be of help when you make estimated tax payments. That way, you may be able to reduce your quarterly obligation during the 2021 tax year and won’t have to wait until you file in 2022 to see savings.

Time: Make sure your billable hours are billed.

Unless you have an organized, easy-to-use method for tracking billable time, some hours are likely to fall between the cracks. QuickBooks Online provides effective tools in this area; you might remember reading up about them in this previous article. As you go through your downloaded transactions, you may see expenses that can be billed to a customer. Select the Customer/project and check the Billable box so you’ll be able to include it on their next invoice.

You can mark expenses as billable to customers in your Transactions register. As you create time entries for you and/or your employees, you can also mark those hours as billable.

Reports: Run basic, critical reports regularly.

You can’t know how your business is doing financially unless you create reports. Besides the quarterly and standard financial reports we can run and analyze for you, you can—and should—be generating reports yourself through QuickBooks Online. Here are some of the ones we suggest:

Budget vs. Actuals. If you’ve put the time and effort to create a budget, it’s critical that you gauge your progress regularly and make adjustments as needed.

Open Invoices. Whom have you billed that hasn’t paid?

Accounts Receivable Aging Detail. Who owes you, and how far behind are they?

Sales by Product/Service Detail. What is selling well and what isn’t? You can make decisions about your product and service lines by viewing this report. This is especially important when your sales are sluggish.

Business Snapshot. This is a series of charts and lists that provides a quick visual overview of key data.

Even though QuickBooks Online can’t correct conditions caused by the pandemic that are out of your control, you shouldn't feel disempowered from managing the conditions that are within your control.QuickBooks Online is designed not only to automate and streamline your daily accounting work, but to also provide the information you need as you evaluate your present situation and plan for the future. Please call on us if you need help making optimal use of QuickBooks Online.

Comments