Recurring Transactions in QuickBooks Online can save time and keystrokes

- Susan Cook

- Mar 7, 2023

- 3 min read

Updated: Dec 15, 2023

Your time and your team's time can make a difference in your profitability and efficiency as a business! Recurring Transactions in QuickBooks Online can eliminate time spent on duplicate data entry.

Accurate accounting takes time. And in order to optimize your business, it's essential to look for opportunities to eliminate unnecessary tasks in your workflow. For example, if you make monthly loan payments or send monthly invoices for the same amounts to customers, it would be ideal if you could avoid entering that information a second or third time, wouldn't it?

The good news is that the recurring transaction feature in QuickBooks Online makes this a reality. For forms that you repeatedly create with very few changes (like utility bills), you can "memorize" the transactions. Then when the bill comes around the next month, you can modify any details necessary and dispatch it again. Let's dive into how the recurring transaction feature works, starting with recurring receivables.

Creating a Recurring Invoice

To get started, enter a transaction that you'd like to save and have the ability to use again (with changes). In this example, let's say you have a customer with a network maintenance service contract whom you invoice monthly. When you're finished building their invoice, look for Make recurring toward the bottom of the screen and click it. The screen will now read Recurring Invoice, with new content as pictured below.

You can specify transactions as recurring and add details like frequency and start/end dates.

Understanding Your 3 Options for Automating Invoices

Next, change the Template name to something that will remind you of its purpose. In the field beneath Interval, select how frequently the recurring invoice should be populated (Daily, Weekly, Monthly, or Yearly) and then indicate the day of the month on which the transaction should occur. Enter a Start date and End date, or select None if the length of service is open-ended. In the example above, you would receive a reminder from QuickBooks Online three days before the invoice is scheduled to go out. The service contract has no ending date, so you'd continue to get these reminders until you change the template.

Next to the Template name is a field labeled Type. QuickBooks Online gives you three options for taking action on the recurring transaction. It can be:

Scheduled: This automated option is ideal for invoices that won't require modifications from one month to the next. If you select this, your transaction will go out as scheduled with no intervention from you. Only the date will change.

Reminder. This feature is a better fit if you need to review each invoice before sending it to a customer. QuickBooks Online will send you a reminder ahead of the scheduled date. You can specify how many days ahead you should receive the reminder. Once you've received a reminder, it'll be up to you to make any necessary changes and ship the final invoice to the customer.

Unscheduled. QuickBooks Online will do nothing except save your template.

When you've completed all required fields, click Save template in the lower left.

Using Recurring Transactions

If you've chosen the Scheduled option for any transactions, you won't need to do anything with them unless their contents or statuses require modification. You can find a list of all recurring transactions, including those you previously earmarked as Reminder or Unscheduled, by navigating to the gear icon in the upper right corner of your QuickBooks Online screen. From the drop-down menu that appears, look for Lists and click Recurring transactions.

The Recurring Transactions table.

The screen that opens will display a table containing all of your recurring transactions. You can learn nearly everything you need to know about these transactions here: Template Name, Type, Txn (Transaction) Type, Interval, Previous Date, Next Date, Customer/Vendor, and Amount.

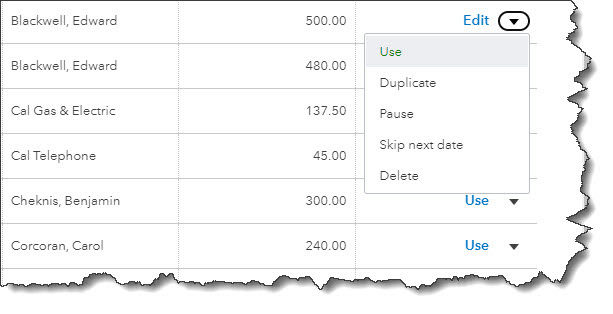

The last column in the table, labeled Action, opens a menu that displays different options depending on the type of transaction. These will look something like:

Edit (edit the template, not the transaction)

Use (open the original transaction that you can edit, save, and send)

Duplicate (duplicate the template)

Pause (stop sending reminders temporarily)

Skip next date

Delete

Freeing Up Time

If manual work has been a pain point of your accounts receivable process, the Recurring transactions feature should help refine this. If you're looking for more ways to automate your invoicing specifically, check out our helpful article on automating customer reminders here: https://www.accountabilityadvisor.com/post/how-to-automate-email-reminders-for-overdue-customers.

As always, if you have any questions about the information we've shared today, reach out to us.

Comments